Affordability, a Dividend, and a Shutdown

What a wild week. Democrats feel like they finally have some momentum, President Trump is talking about a $2000+ tariff “dividend,” and the longest ever government shutdown becomes official. Process that last sentence for a second. The remarkable thing is its just part of the political dynamic right now.

🔴 House Republicans Feeling the Blues? 🔵

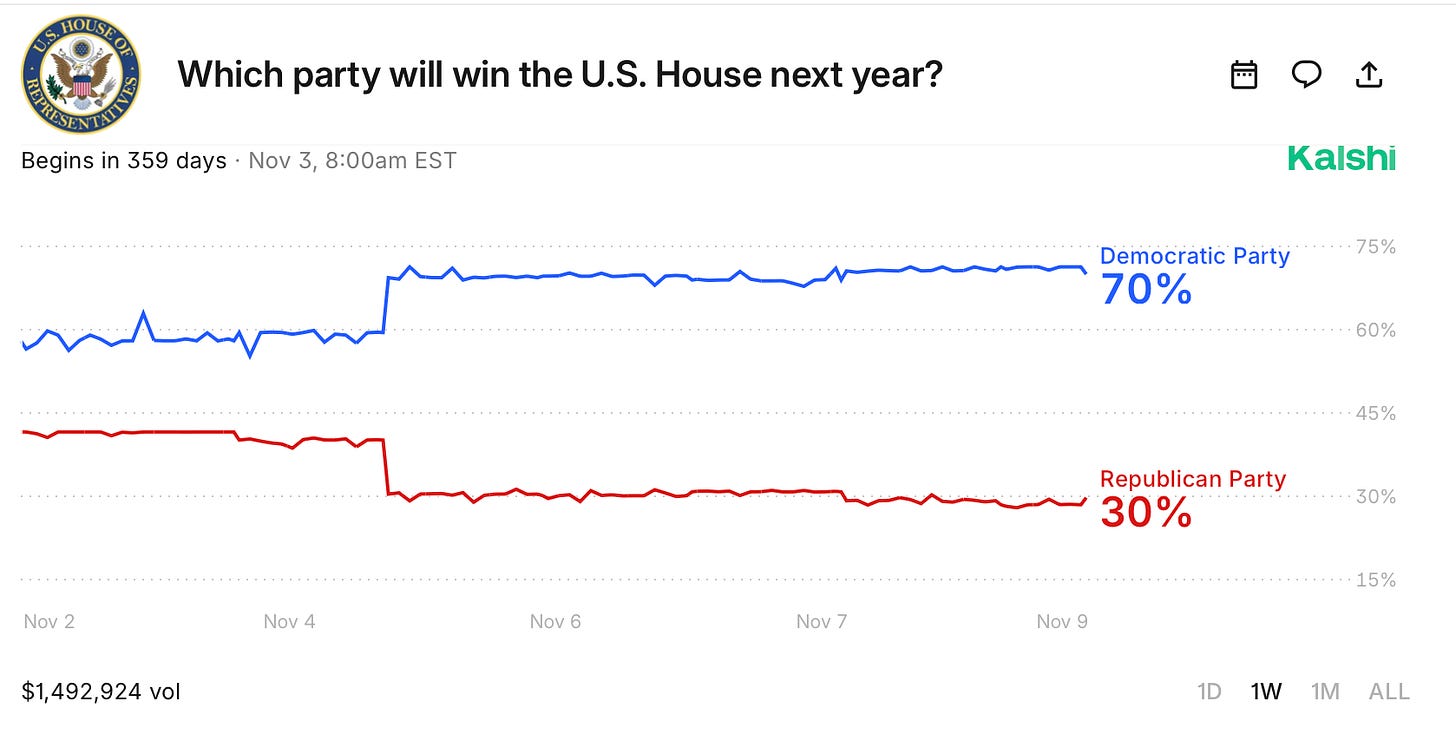

As I wrote last week, there was a spread between the polling and the political prediction markets on who will control the House of Representatives in 2026. The generic Congressional ballot average is D +2.5, but the prediction markets are much more bullish on Democrats’ chances to flip the House.

Keep in mind, the House margin right now is the narrowest in the history of modern politics. The 2024 election led to Republicans with a 220-215 edge. So, it wouldn’t take a political earthquake for the House to potentially to flip (or remain in Republican control). A big question, though, remains: how redistricting will play out, and what could the net effects be in the totality?

And how about this for both the inverse and some symmetry:

The Senate is basically a 70-30 in the prediction markets also, but in favor of Republicans. They do have to defend more seats than Democrats in ‘26, but Republicans currently hold 53 seats.

Tuesday’s elections certainly showed that the affordability issue that was there for Democrats in 2024 is still very much there for Republicans in 2025, and likely will be the top issue in 2026. However, the dynamics simply favor Republican Senators at the moment, which could be why an 80-20 belief from earlier this year in the prediction markets is still a solid 70-30 now.

💸 Is Trump’s Response a Tariff Dividend?

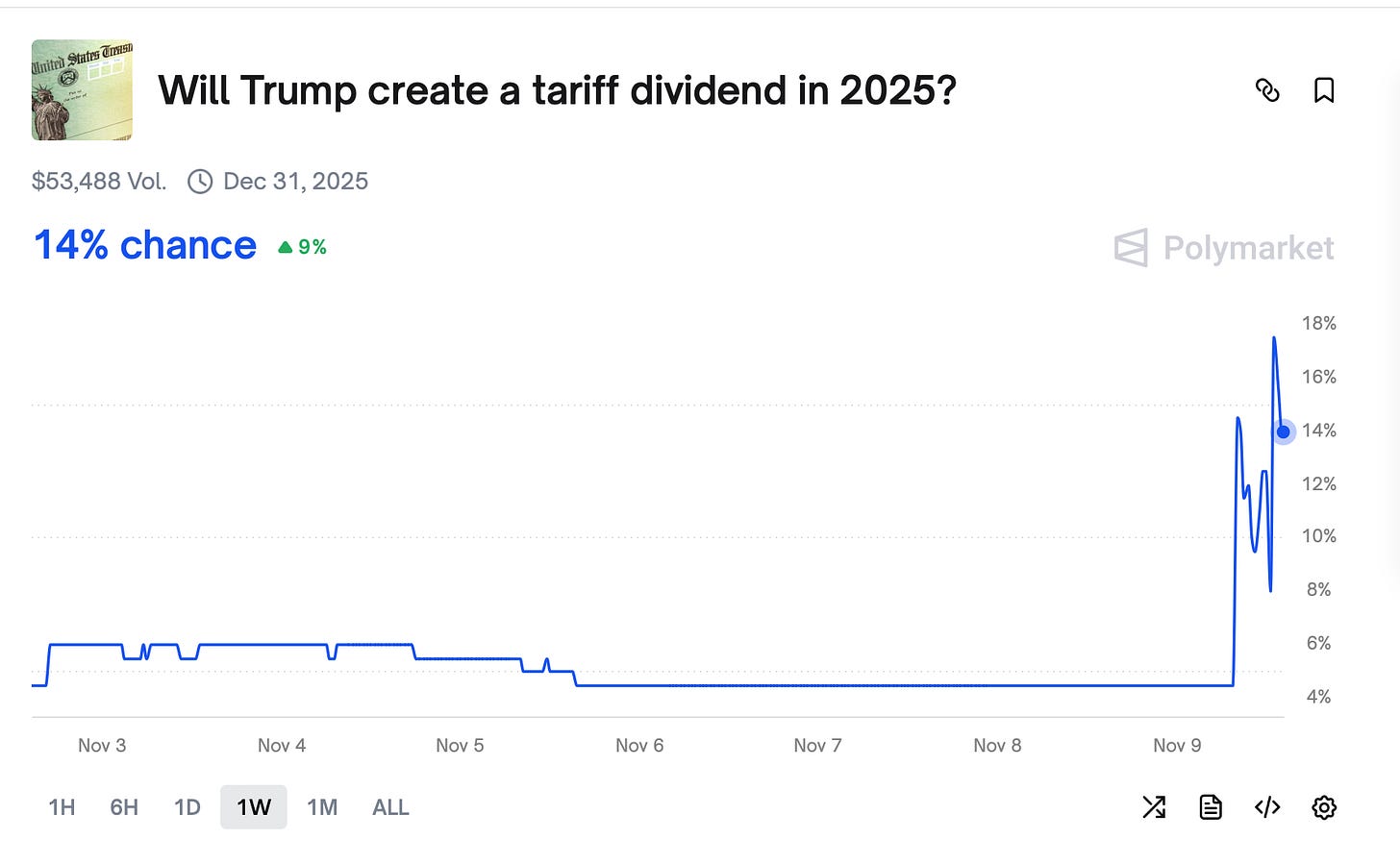

President Trump posted Sunday morning that a tariff “dividend” of at least $2000 is coming. No real details beyond that, but it comes after the affordability message from Tuesday’s elections.

What are income levels? When will it come? Will it be taxable? Will Congress be involved? Those are just some of the questions that immediately come to mind.

There’s a small market right now around this concept, but the yes/no contracts are a heavy no at this point when it comes to a dividend taking shape this year. After all, the government is currently shut down.

🦃 Turkey Day Timeline?

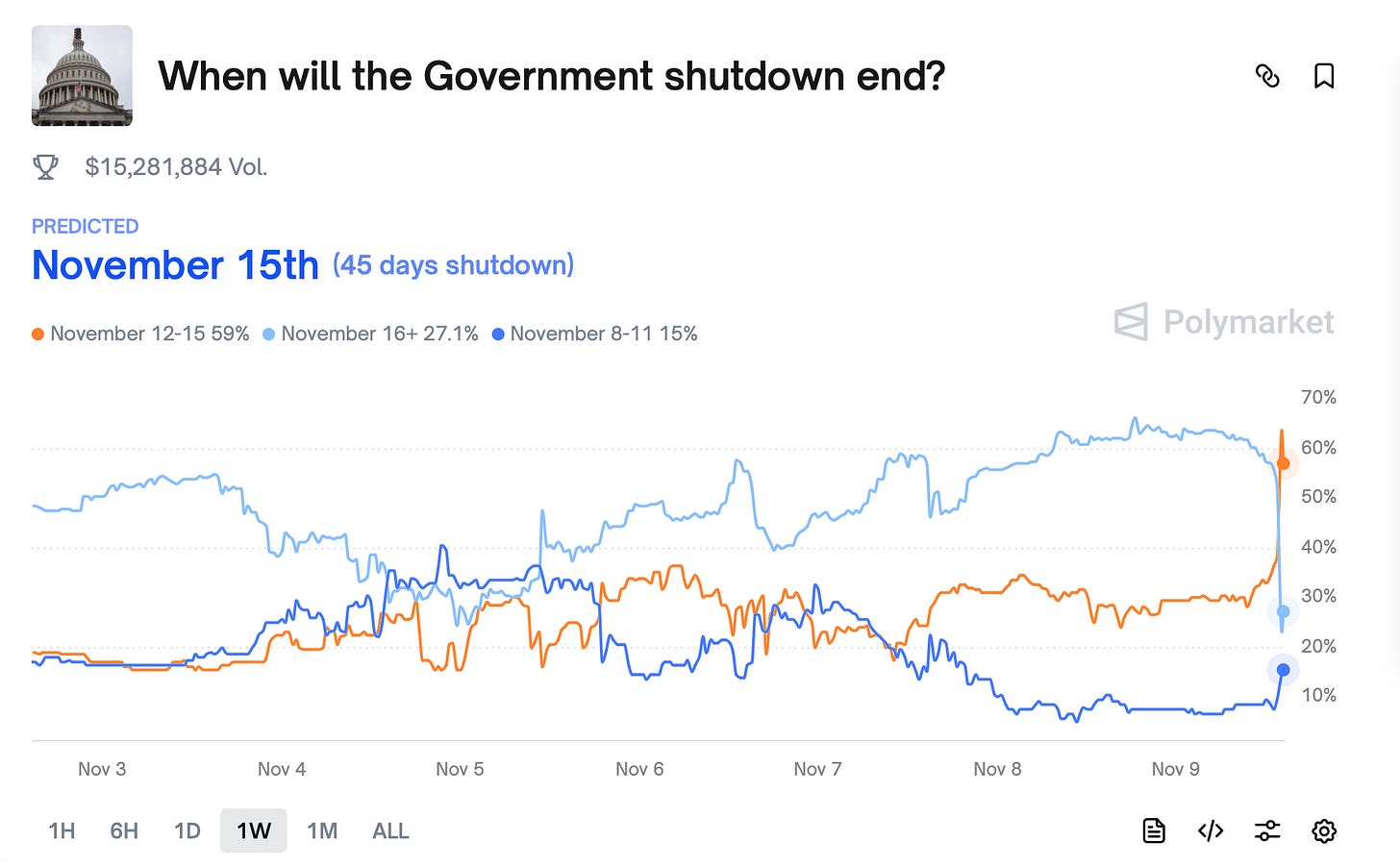

When it comes to the government shutdown, think of the 100 meter hurdle race for a second. There hasn’t been a single hurdle yet to end the shutdown. Federal workers missing paychecks? Nope. Military pay issues? Fixed that. SNAP benefits? The shutdown continues.

Now it seems like we are on the air travel hurdle, as flights are being cancelled and delayed all over the place. Still, the shutdown continues. Prediction markets still believe this ends right around day 45, which would be the end of this week.

I have yet to hear a clear explanation or roadmap as to how this will end. Both sides are dug in. Republicans, especially in the House, say open up the government and then let’s talk. Democrats now feel emboldened after Tuesday’s elections and say Obamacare tax credits need to be taken up now to make health insurance more, here’s the word again, affordable.

At some point, you’d think the House is going to have to come back to Washington because the short term funding bill they passed calls for a November 21st end date. That, of course, is the Friday before Thanksgiving. Lawmakers don’t like messing with their own vacations. We’ll see if the Thanksgiving holiday is the final hurdle that is just too big to mess with.

Hope to see you around here, as I give you some of my thoughts on where money is moving. No red or blue, just green.

Have any comments? I’d love to hear from you!

And don’t forget to subscribe if you are just seeing this for the first time.

Hope you have a great week ahead.

-Blake

Please note: This newsletter is not financial or investment advice, nor is it an endorsement of any type of investment activity.